Simply put, inflation is like shrinking your money and your financial power. Read on to learn more about it and find ways to save money in this though environment.

Did you know that experts project that inflation will continue across the world for the foreseeable future?

Since inflation in the United States is higher than it’s been for the past forty years, many people have been wondering if there is an end in sight. Even though the inflation rate will eventually go back down, nobody knows when this will happen.

Therefore, consumers are going to need to get creative when spending and saving money if they want to continue to be financially stable. To help you to understand when inflation might end and how this might affect your life, we’ve created a guide. Keep reading and we will tell you what is important to know.

What is causing the inflation?

On one hand, the pandemic created shortages in labor, supply chain and logistical disruptions impacting the amount of goods produced and available to consumers. On the other hand, consumers didn’t spend as much during the pandemic and have cash, which drives demand more products.

The resulting imbalance has contributed to prices climbing 9.1% in June compared with the year before.

The Relationship Between Inflation and Energy

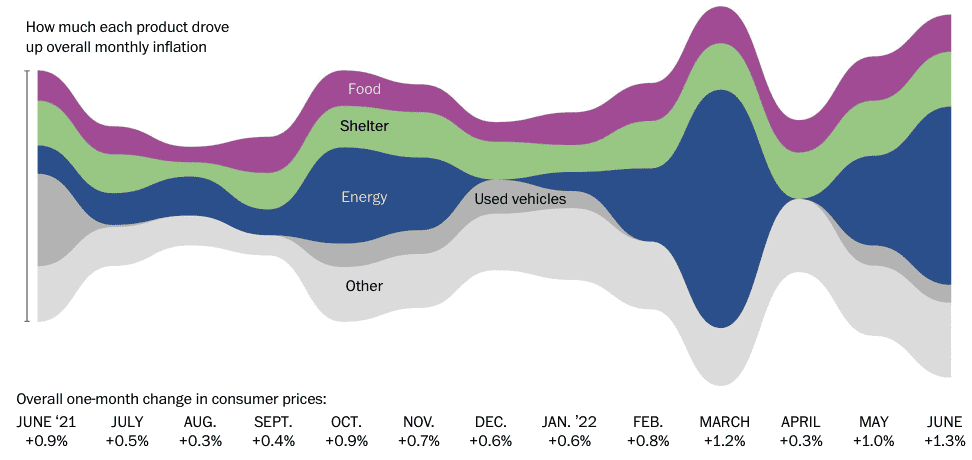

Energy has been the main driving force behind price increases as shown in the graph below published by the Washington Post.

Energy prices have skyrocketed, gasoline is up 60%, gas 38% and electricity 14%. This high energy prices compounded with the summer, when households use more energy to keep their homes cool, is making everyone’s bills go through the roof.

When the winter comes, people also use more energy to heat their homes. This means that the average American will need to spend a larger portion of their paychecks on energy costs in the summer and in the winter.

To make things worse, Russia’s invasion of Ukraine has further impacted global supply chains and strained global energy markets. The impact is felt at home with gasoline prices exceeding $5 last month.

Therefore, it is so important for people to know their home energy scores and find out how much energy is wasted in their homes. This combined with smart shopping for the cheapest energy rates will give homes relief in their energy bills.

Politicians Say that Dealing with Inflation Is a Top Priority

Politicians on both sides of the political divide agree that they need to continue to take action to put a damper on inflation.

In addition to high gas prices, food and housing continue to become more expensive. Grocery and energy prices have risen by nearly twelve percent, which is the highest that they’ve risen since nineteen seventy-nine.

Based on June 2022 consumer price index, cereals and dairy increased 14%, meats and eggs 12%, and fruits and vegetables 8%. Even the prices of used cars have increased.

To slow down the rate of inflation, the Federal Reserve has stepped in and raised interest rate in ¾ of a percentage point in June. This is the highest interest rate increase since 2000. Higher rates will slow the economy by making it more expensive to borrow money, which will discourage businesses from expanding and raise the cost of consumer loans like mortgages.

This is off course a very delicate balance and on the flip side, creates a risk that the country could go into a recession. If interest rates get too high, there can be unintended negative consequences in the job market and the recovery.

What Experts Say About the Future of Inflation

Most experts think that countries around the world will have record inflation in the months ahead. Even though fuel prices fell in the middle of 2022, it’s very possible that they will rise again.

Experts also say that inflation will continue for the next year to year and a half. In a recent poll, only twenty percent of industry experts said that they believe inflation will slow down in the second half of 2022.

Keep in mind that there are a lot of variables that determine the rate of inflation. For example, if the war between Russia and Ukraine ends sometime soon, it is possible that energy prices will go down.

Tips to cope with Inflation and save money

Inflation is probably going to continue for the foreseeable future. Even though many people are frustrated that gas is expensive and that energy prices continue to rise, the rate of inflation will eventually go down.

If you are trying to find a way to save money during times of inflation, we are here to help, here are some helpful tips:

- Create a budget

- Track your spending and reduce waste

- Compare prices and do smart shopping

- Find free alternatives to paid subscriptions

- Sign up today to EnerWisely to find the cheapest electricity and start eliminating energy waste.